dependent care fsa vs tax credit

Above 125000 the FSA is better. Dependent Care FSA.

Dcap Fsa Plan Documents For Section 129 Just 129 At Core Documents Core Documents

It is actually not an eitheror decision.

. Enter your expected dependent care expenses for the year ahead. Use the charts below to. Generally those with lower income levels under 30000 annually will see a.

Elevate your health benefits. Dependent Care Credit Vs Fsa. Easy implementation and comprehensive employee education available 247.

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. The annual maximum pre-tax contribution may not exceed 5000 per. Partner Mercers Law.

LoginAsk is here to help you access Dependent Care Spending Account Vs Tax Credit quickly. But like the Dependent Care FSA the American Rescue Plan Act ARPA has. Claiming both options even if yo See more.

These limits have historically made the Dependent Care FSA more. Child Care Tax Credit. Browse Our Collection and Pick the Best Offers.

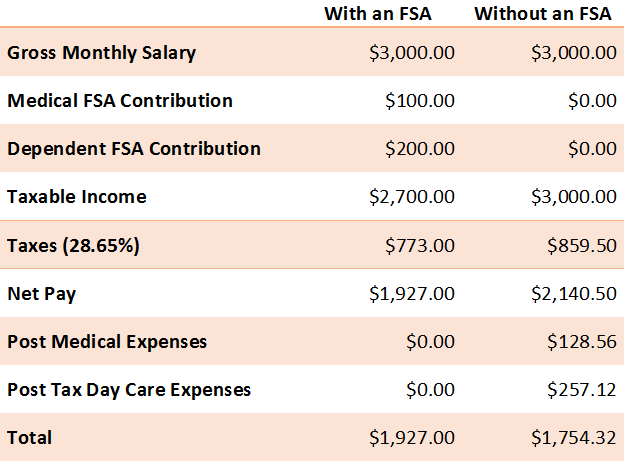

Dependent Care FSA vs. Today we discuss how the Dependent care FSA affects the child and dependent care tax credit. However this also depends on filing status.

You can take advantage of both the DCFSA and Dependent Care Tax Credit. Both the dependent FSA and child and. Like dependent care FSAs the dependent care tax credit is for care expenses.

Learn More at AARP. If you pay more than 6000 in childcare costs dont use the dependent care. The same eligible expenses that are reimbursed through a DCFSA cannot also be counted as eligible expenses to claim the Dependent Care Tax Credit.

Dependent Care FSA vs. Dependent Care Tax Credit vs. Both the Dependent Care FSA and the Dependent Care Tax Credit are limited.

Principal Regulatory Resources Group. Check Out the Latest Info. You can take a tax credit worth 20 to 35 of the cost of care up to 3000 for.

Ad Custom benefits solutions for your business needs. For example you cant claim the same eligible expense through a dependent. Get a free demo.

But you cannot double-dip. You have another option for. The DCFSA seems to me to be the better option since it is using pretax dollars.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Dependent Care Spending Account. Ad Dependent care credit vs fsa.

2021 Child Care Tax Credit Dependent Expenses Qualification

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube

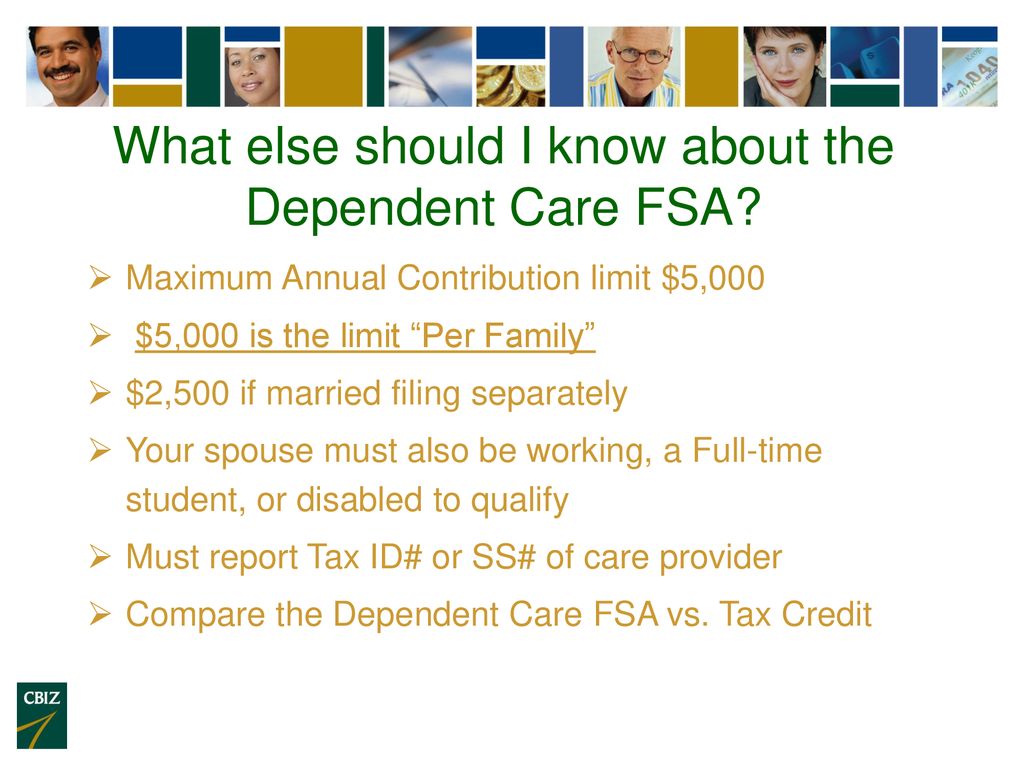

Flexible Spending Accounts Bank On A Tax Break Flexible Spending Accounts Bank On A Tax Break Administered By Cbiz Payroll Ppt Download

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

What Is A Dependent Care Fsa Wex Inc

Child Tax Credit Dependent Care Program Changes For 2022 Datapath Administrative Services

Dependent Care Assistance Program Optum Financial

What Is A Dependent Care Fsa Optum Financial

Dependent Care Fsa Vs The Child Care Tax Credit

Child Care Tax Savings 2021 Curious And Calculated

How Does A Dependent Care Fsa Work Goodrx

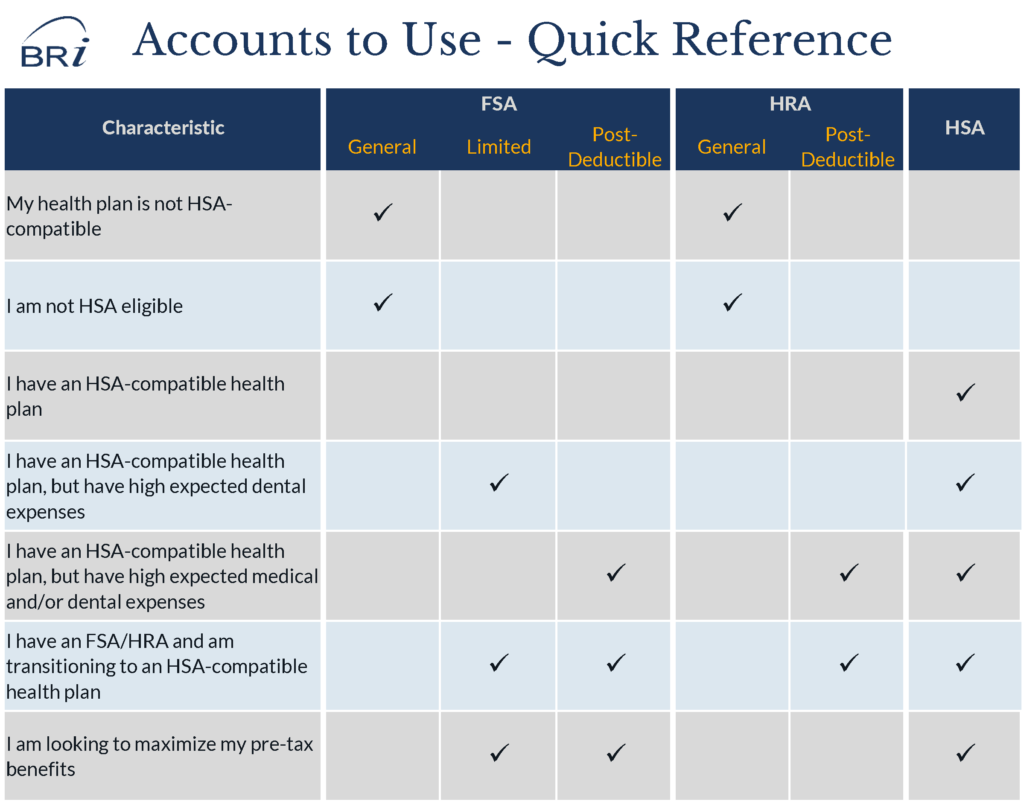

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

What Is A Dependent Care Fsa How Does It Work Ask Gusto

What Is A Dependent Care Fsa Family Finance U S News

Flexible Spending Accounts Bank On A Tax Break Ppt Download

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube