long island tax rate

So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in. What is the sales tax rate in Long Island Maine.

What Are The Taxes On Selling A House In New York

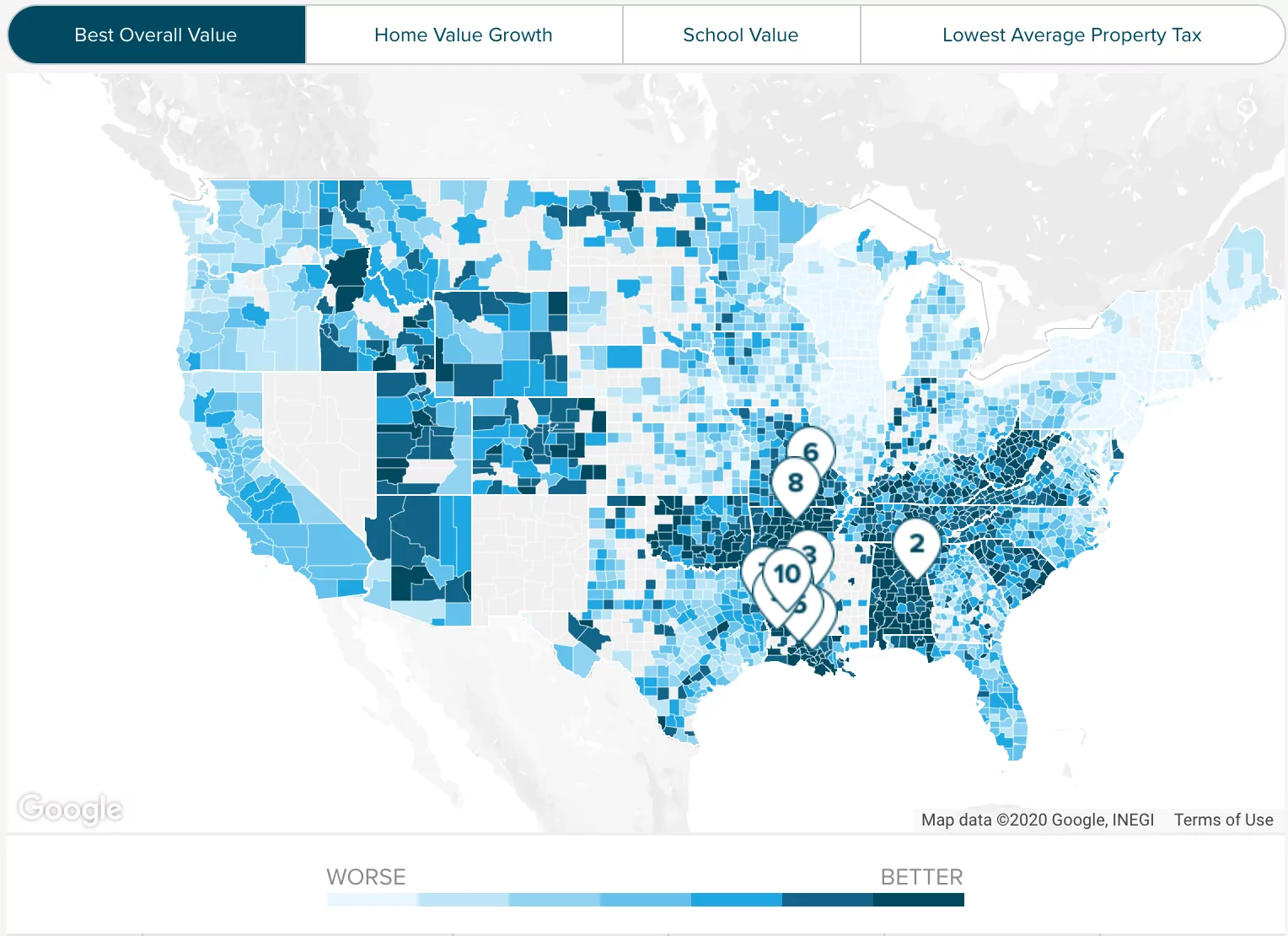

In case none of the ways to help you pay property taxes work out you should look at real estate in other states.

. 2021 List of New York Local Sales Tax Rates. The Long Island sales tax rate is. The December 2020 total local.

The minimum combined 2022 sales tax rate for Long Island Maine is. Has impacted many state nexus laws and sales tax. This means that property values in Long Island are more than twice the national average.

Average Sales Tax With Local. There are a total of 640 local tax jurisdictions across the state collecting an average local tax of 4254. ZIP Codes with fewer.

2020 rates included for use while preparing your income tax deduction. New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875. The Nassau County sales tax rate is.

To learn more call 631-761-6755. The County sales tax rate is. This means that property values in Long Island are more than twice the national average.

The California sales tax rate is currently. Did South Dakota v. This is the total of state and county sales tax rates.

Property Values Are Higher. Proper notification of any levy hike is also a requirement. There are approximately 21036 people living in the Long Island City area.

This is the total of state county and city sales tax rates. The Long Island sales tax rate is. For this reason those who live here will naturally have higher property assessment rates.

1 be equal and uniform 2 be based on present market worth 3 have a single appraised value and 4 be deemed taxable in the absence of being specially exempted. Lowest sales tax 7 Highest sales tax 8875 New York Sales Tax. The Long Island City sales tax rate is 45.

Remember that zip code boundaries dont always match up with political boundaries like Long Island or Phillips County so you shouldnt always rely on something as imprecise as zip codes to determine the sales tax rates at a given address. An alternative sales tax rate of 725 applies in the tax region Norton which appertains to zip code 67647. Taxation of real property must.

The Long Island City New York sales tax rate of 8875 applies to the following three zip codes. Long Island City NY Sales Tax Rate. How to Challenge Your Assessment.

What is the sales tax in Suffolk County NY. Sales tax rates. The 2018 United States Supreme Court decision in South Dakota v.

The first map below shows property tax averages for ZIP Codes on Long Island and the second map shows overall SALT levels. What is the sales tax rate in Long Island California. The current total local sales tax rate in Long Island City NY is 8875.

11101 11109 and 11120. The Maine sales tax rate is currently. Property Values Are Higher The median price of homes in Long Island is about 500000.

In Nassau County the average tax rate is 224 according to SmartAsset. Dependent Child Care Credit - 20 to 110 of your federal child credit depending on your New York gross income. Check out some of the states with low property tax rates.

New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875. The County sales tax rate is 0. The minimum combined 2022 sales tax rate for Long Island City New York is 888.

The County sales tax rate is. Remember that zip code boundaries dont always match up with political boundaries. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in.

Long Island City tax. Long Island is on the expensive side but various other options are available. The median price of homes in Long Island is about 500000.

There are a total of 987 local tax jurisdictions across the state collecting an. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. This is the total of state county and city sales tax rates.

The New York state sales tax rate is currently. This is the total of state county and city sales tax rates. Method to calculate Long Island sales tax in 2021.

In comparison the median price of homes across the USA is about 250000. The combined rates vary in each county and in. Nassau County Tax Lien Sale.

157 rows The average homeowners property tax bill in 89 of the 155 ZIP Codes on Long Island exceeds the 10000 limit for deductibility set in the new federal tax regulations. An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD. The Long Island City sales tax rate is 8875.

The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. Rules of Procedure PDF Information for Property Owners. Did South Dakota v.

Click on the maps for details. For tax preparation accounting services in Suffolk County visit Weisman CPA the most trusted Long Island CPA firm. The latest sales tax rate for Long Island City NY.

Assessment Challenge Forms Instructions. The New York sales tax rate is currently 4. What is the sales tax rate in Long Island City New York.

Applies to children at least four years old who qualify for the federal child credit. What NYS sales tax 2021. The minimum combined 2022 sales tax rate for Long Island California is.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. This rate includes any state county city and local sales taxes. Why are Long Island property taxes so high.

Empire State Child Credit - 33 of the federal child tax credit ot 100 for each qualifying child. Within those limits Long Island establishes tax levies. The minimum combined 2022 sales tax rate for Nassau County New York is.

New York state sales tax.

How Is Tax Liability Calculated Common Tax Questions Answered

State Corporate Income Tax Rates And Brackets Tax Foundation

Us New York Implements New Tax Rates Kpmg Global

What Are The Taxes On Selling A House In New York

How Do State And Local Sales Taxes Work Tax Policy Center

New York Property Tax Calculator Smartasset

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What Is The Llc Tax Rate In New York Gouchev Law

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

What To Know Before Moving To Long Island

State Income Tax Rates Highest Lowest 2021 Changes

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Crypto Tax Free Countries 2022 Koinly

New York Paycheck Calculator Smartasset

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time